Documentation

Documentation

If you have set up your website to accept PayPal payments directly into your PayPal account, then you should understand that PayPal charges fees for each transaction. The fees are:

| For-profit organization | $0.49 per transaction + 2.9% of the amount |

| Non-profit organization | $0.49 per transaction + 2.0% of the amount |

A few notes about this:

Some made up examples of transaction amounts and the actual fees that you would pay for those amounts are given below:

| Description | Amount | Fees (for-profit) | Fees (non-profit) |

| Charitable donation | $100.00 | $3.20 | $2.50 |

| PTA family membership | $20.00 | $0.88 | $0.74 |

| Four slices of pizza | $10.00 | $0.59 | $0.52 |

| One event ticket | $5.00 | $0.45 | $0.41 |

Note that the $0.30 portion of the fee is per transaction, not per item. So, if you sell multiple items through your website, and your visitor pays for all of them in a single transaction, then your fees will be $0.30 for the entire transaction, plus the appropriate percentage (either 2.9% or 2.2%) of the total transaction amount.

PayPal deducts the fees automatically before depositing the funds into your account. So, if a visitor on your site purchased $20 worth of goods, and chose to pay using PayPal, then only $19.26 would get deposited into your PayPal account.

Because of the fees, organizations who choose to offer PayPal as a payment option will make less profit than those choosing to only accept checks. Still, it can be worthwhile to offer PayPal because parents appreciate the convenience of being able to pay by credit card online rather than having to write a check and send it in to the school. Also, some parents may be willing to spend a little bit more money on your site when they know that they can pay with a credit card.

You may decide you want to increase the price of your items slightly in order to help you cover the fees. That's fine, but you cannot charge extra only for those parents who are paying by PayPal. In other words, the price of your items must be the same for all visitors, regardless of payment type.

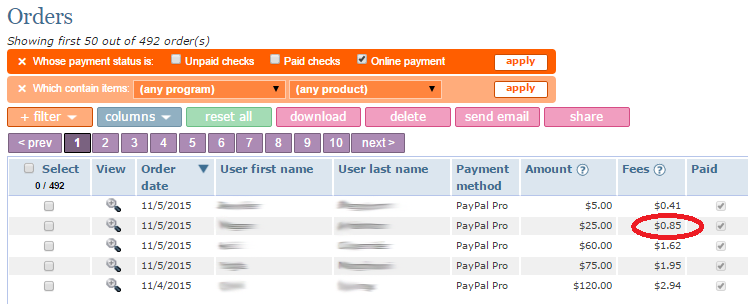

Your Our School Pages website includes reports that show exactly how much was paid in fees, either per order, or per item. To see this, sign in as the Admin, and visit your Orders report or your Order items report. You may need to add the Fees column to display in the report.

From a Treasurer's perspective, there are different ways you can budget for the fees. The one we recommend is to treat the fees as if they are part of the cost of the goods that you are selling. So, for example, if your organization is selling science fair project boards, you may be purchasing the boards at $3.50 per board from the supplier, and then reselling the boards to the students/parents for $5.00 each. However, if you are offering PayPal as a payment option, then the cost of each board ends up being a little bit more than $3.50. If you are expecting roughly half of the parents to pay using PayPal (and the other half pay by check), then your cost is about $0.20 extra per board to cover the fees. So, when budgeting for the science fair, you should assume that you'll be paying about $3.70 per board, and selling them for $5.00.

For bookkeeping purposes, it is useful to keep the PayPal fees under the program in which they were actually incurred. So, in your books, for the PayPal fees you incurred through science fair sales, keep them in a line item called "PayPal Fees" under the "Science Fair" category. This way, at the end of the year, you still have an accurate picture of how much profit/loss you incurred for each program, with the fees taken into account. Instead, some organizations choose to create a top level line item in their books called "PayPal fees" which includes the fees for the entire year for all programs. This is fine too if this makes more sense for you. However, we feel this is less useful since it doesn't properly differentiate between programs that chose to offer PayPal and those that didn't.